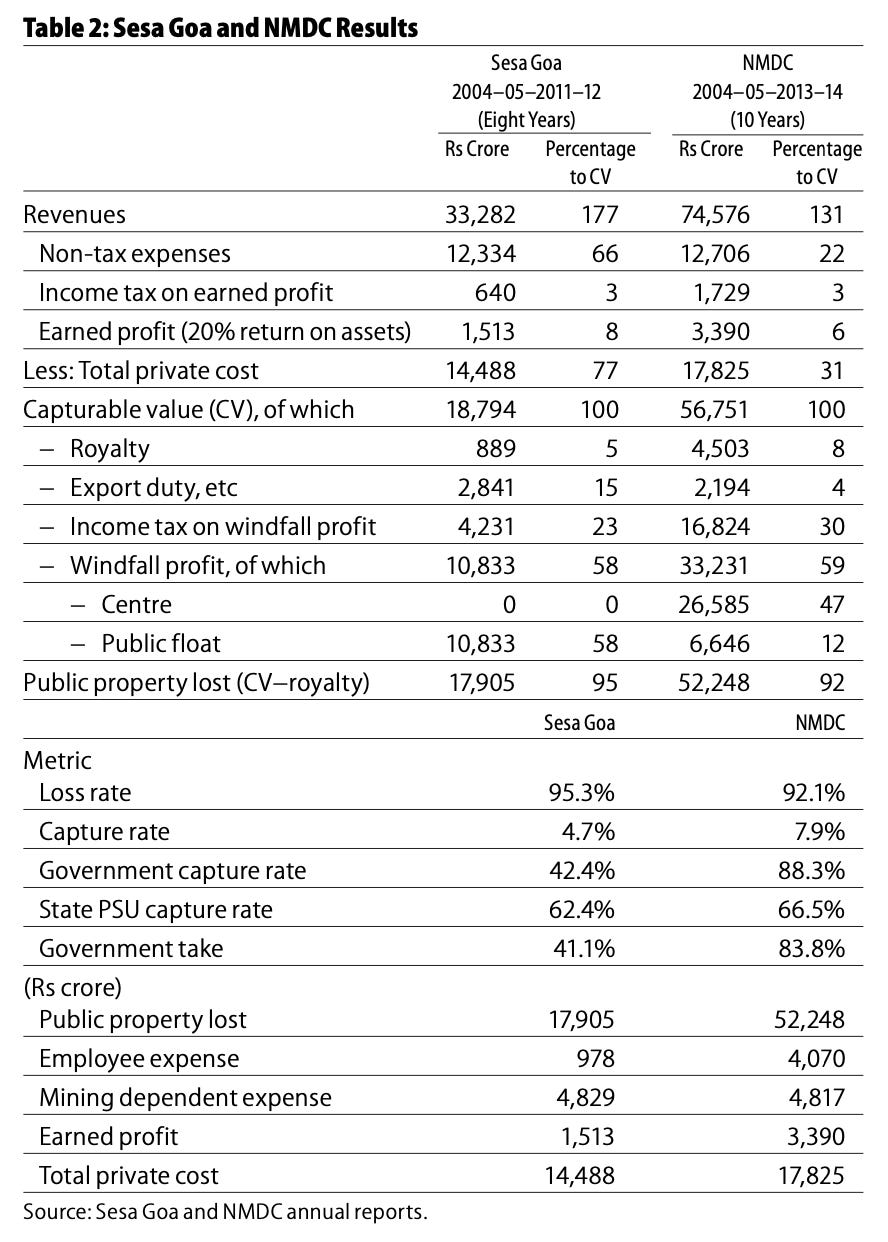

In this post, I want to show some figures from an interesting case study done by Rahul Basu, in which they calculate the rent from all iron ore mining in Goa from 2004 to 2012 and shows how it was 20 times the royalty collected by the government.

Credit: Rahul Basu / Goa Foundation

This shows the total on-book sales of Iron Ore extracted from Goa by Sesa Goa (Vedanta), from FY5-FY12, and the state-owned mining company, National Mineral Development Corporation (NMDC), from FY5-FY14. It estimates the economic rent by subtracting non-tax expenses, a 20% return on assets and the taxes on that income. This economic rent is around 20 times the royalties collected, i.e. only 5% of the rent was collected via royalties. Most of the rent went to the miner while some of it went to the Central government via taxes. Part of the rent might have also been paid as dividends to the Central government (which owns ~60% of NMDC). Note that royalties from sub-soil mineral are owed to the state government and are defined in law.